FA58 Franchising Grows In A Tight Economy

FASA

FRANCHISING GROWS IN A TIGHT ECONOMY

By Staff Writer • November/December 2017 • Issue 58

Download PDF Version • 480 KB

Since FASA commissioned the first franchise industry survey in 2013, the industry has increased its contribution to the country’s GDP from 9.7 percent to 13.3 percent.

When the Franchise Association of South Africa (FASA), together with sponsor Sanlam, commissioned Research IQ to conduct a survey of the industry and track its growth in 2013, South Africa and the world had already been in a recession for five years. Despite trying socio-economic conditions, political uncertainty and tough trading conditions, the franchise sector turnover has increased from R465-billion in 2014 to R587-billion in 2017 and its contribution to the country’s GDP has increased from 9.7 percent to 13.3 percent over the same period.

“As a sector, we are doing great things in a tight economy,” says FASA Chairman, Tony Da Fonseca.

“Tracking our success and looking for areas that need improving is part of the entrepreneurial nature that sets us apart as franchisors and franchisees. This is borne out by the fact that 78 percent of the franchisors surveyed are optimistic about future growth in their businesses. The fact that this figure has dropped from 92 percent during the previous survey, signals that the country’s economic woes are affecting even the most resilient business people, and whilst we celebrate our tenacity in staying the course, we must be cognisant of the subtle undercurrents of uncertainty that the survey has exposed.”

Sanlam, also tracks the continuity and planning provisions franchisors and franchisees make as part of their business strategy. “While it is concerning that continuity planning amongst franchise owners has declined in the past three years, it is encouraging to note that the majority of franchise owners (95 percent) claim to have an investment portfolio largely comprising retirement annuities and property,” says Kobus Engelbrecht, Marketing Head: Sanlam Business Market.

FRANCHISE SURVEY HIGHLIGHTS

Growth despite trying conditions

With an estimated turnover of R587- billion, the franchise industry contributes 13.3 percent to the South African GDP. As the largest sector, the Fast Food & Restaurants sector contributed 29 percent to this figure, while the Building, Office & Home Services, Retailing and Business-to-Business Services sectors collectively contributed 43 percent.

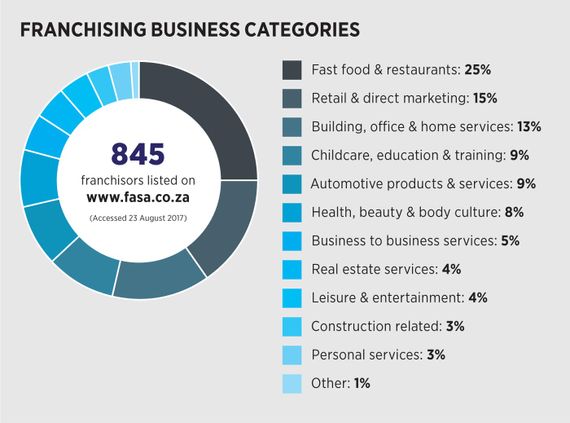

At 25 percent, the Fast Food & Restaurant category is the largest franchise sector, followed by the Retail Sector at 15 percent and the Building, Office & Home Services sector at 13 percent. Automotive Products & Services, and Childcare, Education & Training contribute around nine percent each followed by Health, Beauty & Body Culture at eight percent. The remaining categories contribute five percent or less.

Amongst the 40,528 franchise stores belonging to the 845 franchised systems operating in South Africa, 85 percent are owned by franchisees compared to 95 percent a year ago, revealing a shift towards company-owned stores and joint ventures.

In 2017, 71 percent of the franchisors interviewed claimed that they had opened a total of 2,789 businesses and the sector split was noted as follows: Fast Food & Restaurants 25 percent, Retail 26 percent and Health, Body & Beauty Culture 16 percent. Of the estimated 105 franchises that closed during the survey period, the Fast Food & Restaurants and Retail sectors contributed 26 percent each and the Health, Body & Beauty Culture sector 19 percent.

Contributing to job creation

Of the 343,319 employees in the franchise sector, around 20,000 are employed by franchisors and the balance by franchisees. The ethnic split of employees in the franchise sector was recorded as 65 percent black, 24 percent white, six percent coloured and five percent Indian. The number of black employees has increased by eight percent.

Ownership by Previously Disadvantaged Individuals (PDIs) for 2017 was given at 17 percent, similar to the 18 percent recorded in the 2016 survey, while just over half of the respondents reported no PDI ownership in their businesses. Since the 2015 survey there has been a slight downward trend in PDI ownership which may be due to changes made to the B-BBEE Act of 2013.

Business ownership by women recorded the highest percentages in the Health, Beauty & Body Culture and Childcare, Education & Training sectors with the overall average logged at 25 percent.

Business success & challenges

The number of franchisors who are optimistic about the future growth of their business has dropped from 92 percent in the previous survey to 78 percent in 2017 and there is a concomitant increase in the number of franchisors who are uncertain about the future. 40 Percent of franchisors now believe that it will take new franchisees longer than a year to break even; this is up from 26 percent in the previous survey.

Two in three franchisors claim to have been in business for longer than ten years and a further 17 percent for more than six years. The longevity of these businesses supports the success of franchising and the risk mitigating impact of buying into a franchise.

The main challenges facing franchisors remains finding the right people, both in terms of franchisees and suitably skilled staff. Other critical issues include the poor economy, procuring financing for franchisees and securing suitable premises.

Over the last year the number of franchisors who classify their businesses as being in the ‘success’ stage (achieving and nourishing) has increased, while the ‘mature’ (control and profit) category has remained stable. The number of businesses described as ‘ambitious’ (expanding or taking a risk) has declined, with some of these businesses moving to the ‘success’ category.

Site & expansion plans

While 31 percent of the franchisors interviewed claimed to have stores outside of South Africa and mostly in neighbouring countries like Namibia and Botswana, only one in eight franchisors claimed to be represented outside of Africa.

59 Percent of franchisors have business units/stores in shopping centres/malls and 62 percent have them situated in high streets, where most passing trade occurs. A quarter of the franchised outlets are operated from a home base or in an industrial area. Significant increases in the number of businesses on high streets (from 54 percent to 62 percent) and in industrial areas have occurred (from 17 percent to 23 percent). The move to high streets is supported in the Franchisee Survey.

The full FASA/Sanlam Franchisor & Franchisee Survey results can be accessed on the FASA website at www.fasa.co.za

Copyright © 2021 Digital Zoo Website Design Company

- All Rights Reserved

Disclaimer: SA Franchise Warehouse is not associated in any manner to any of the brands listed on this website apart from listing details of their respective franchise opportunities. We do not underwrite their viability as a business opportunity nor the quality of the service or products offered by their franchisees. Any complaints need to be directed to the franchisors directly.